Indicators on $255 Payday Loans Online Same Day You Need To Know

Wiki Article

Indicators on $255 Payday Loans Online Same Day You Need To Know

Table of Contents$255 Payday Loans Online Same Day Things To Know Before You Get ThisAn Unbiased View of $255 Payday Loans Online Same DayWhat Does $255 Payday Loans Online Same Day Do?The Single Strategy To Use For $255 Payday Loans Online Same Day7 Simple Techniques For $255 Payday Loans Online Same DayThe Of $255 Payday Loans Online Same Day

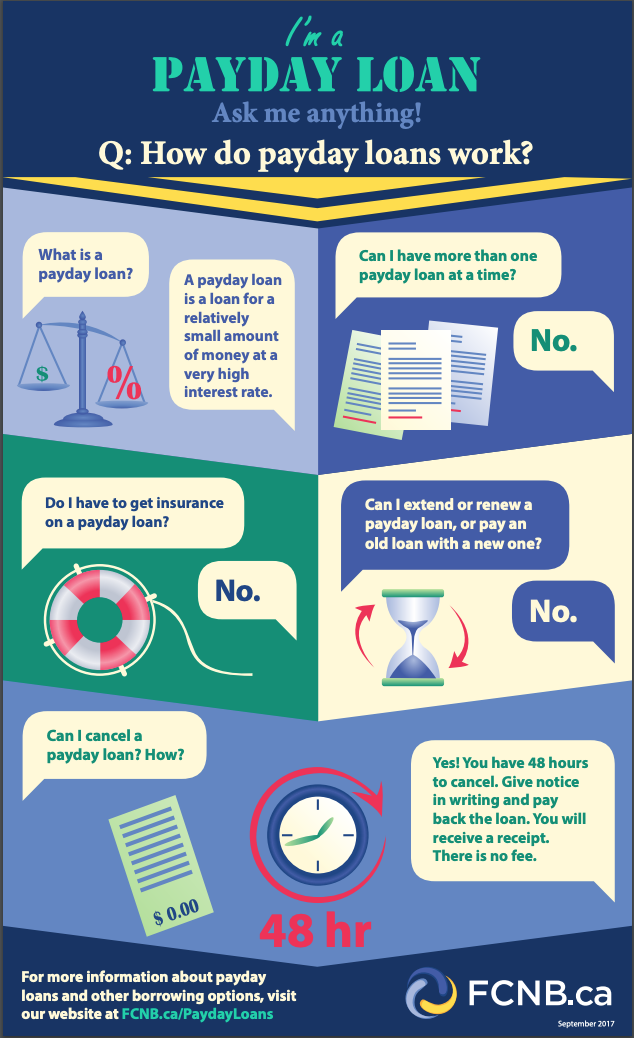

The financings are for tiny quantities, and several states established a restriction on payday advance loan dimension. $500 is an usual car loan restriction although limitations vary over and listed below this quantity. A payday advance loan is usually paid off in a single repayment on the borrower's following payday, or when revenue is gotten from another source such as a pension or Social Safety.

The specific due date is embeded in the payday advance contract. To settle the loan, you usually compose a post-dated look for the complete equilibrium, consisting of charges, or you supply the lending institution with authorization to online debit the funds from your financial institution, cooperative credit union, or pre paid card account. If you don't pay off the finance on or prior to the due date, the loan provider can cash the check or electronically take out money from your account.

The funding proceeds may be supplied to you by cash money or check, digitally transferred right into your account, or packed on a pre paid debit card. Other car loan features can vary. Cash advance lendings are frequently structured to be paid off in one lump-sum repayment. Some state laws permit lenders to "rollover" or "renew" a lending when it becomes due so that the consumer pays only the charges due and also the lender expands the due day of the funding.

The Basic Principles Of $255 Payday Loans Online Same Day

Several state regulations established an optimum quantity for cash advance funding fees varying from $10 to $30 for every $100 obtained. By contrast, APRs on credit rating cards can vary from concerning 12 percent to about 30 percent.

Some states do not have payday loaning since these financings are not allowed by the state's law or since cash advance lenders have actually chosen refrain to business at the passion rate as well as costs allowed in those states. In states that do allow or regulate payday borrowing, you might have the ability to find more details from your state regulatory authority or state chief law officer .

Those defenses include a cap of 36 percent on the Armed force Interest Rate (MAPR) as well as various other restrictions on what lenders can charge for payday as well as various other consumer car loans. Call your local Judge Supporter General's (JAG) office to get more information about offering limitations. You can utilize the buzz Legal Support Office locator to discover assistance.

The Ultimate Guide To $255 Payday Loans Online Same Day

A payday advance loan is a short-term loan that can assist you cover immediate cash money needs up until you obtain your next paycheck. These small-dollar, high-cost finances generally bill triple-digit annual percent prices (APRs), and also repayments are typically due within 2 weeksor near your following cash advance. Cash advance fundings are except the pale of heart.Prior to you apply for one, it is necessary to know what you'll get and what's gotten out of you in return. Payday advance operate differently than individual and various other consumer loans. Depending on where you live, you can get a payday advance online or with a physical branch with a payday click to read lender.

Some states restrict payday advance loan altogether. When you're approved for a payday advance, you might receive cash money or a check, or have the cash deposited right into your savings account. You'll after that require to pay back the lending completely plus the finance charge by its due day, which is usually within 14 days or by your next income.

The Facts About $255 Payday Loans Online Same Day Revealed

Due to the fact that payday advance loan have such short payment terms, these prices translate to a high APR. According to the Customer Federation of America, payday advance APRs are generally 400% or more. Regardless of the high prices, The Economist estimates that roughly 2. 5 million American homes secure cash advance financings annually.

One is that lots of people who consider payday advance don't have various other funding options ($255 Payday loans online same day). They may have bad credit or no income, which can stop them from obtaining an individual loan with better terms. An additional reason might be a lack of knowledge concerning or worry of options. For instance, some people may not be comfy asking relative or friends for support.

Lots of people resort to payday advance because they're simple to obtain. In truth, in 2015, there were more cash advance lender stores in 36 states than Mc, Donald's areas in all 50 states, according to the Customer Financial Security Bureau (CFPB). Cash advance lending institutions have couple of requirements for approval. The majority of do not run a debt check or also require that the borrower has the methods to pay back the finance.

$255 Payday Loans Online Same Day Can Be Fun For Everyone

The best site average cash advance finance is $350 on a two-week term, according to the CFPB. Payday lendings can range from $50 to $1,000, depending on your state's regulations.Some states, including Nevada and New Mexico, also restrict each cash advance to 25% of the borrower's monthly income. For the 32 states that do allow cash advance loaning, the price of the funding, fees as well as the maximum funding amount are capped.: 37 states have certain statutes that enable for cash advance financing.

Arizona and also North Carolina permitted pre-existing payday borrowing laws to sunset. Arkansas rescinded its pre-existing law in 2011. New Mexico repealed its payday loaning laws in 2017. The Area of Columbia repealed its pre-existing statutory stipulation in 2007. The costs connected with payday advance are set by state regulations with costs ranging from $10 to $30 for every single $100 obtained.

Getting My $255 Payday Loans Online Same Day To Work

Let's say you obtain $100 check my source for a two-week cash advance loan as well as your lender is billing you a $15 cost for every $100 obtained. That is an easy rate of interest price of 15%. Yet given that you need to repay the funding in two weeks, that 15% financing fee relates to an APR of practically 400% since the funding size is only 2 week ($255 Payday loans online same day).

Report this wiki page